Stuart Pann, Chief Supply Chain Officer, HP Inc.

SCN: It’s been about two and a half years since the HP separation. What can you tell us about who HP Inc. is today and what it took to get the company to this point?

SP: Obviously with the separation there was a tremendous amount that needed to change in our supply chain organization in terms of systems, logistics routes, supplier relations, organizational structures, etc. But, I think the greatest change has been in the overall structure of our business. We have a simple organizational design with highly defined leadership roles and responsibilities. Our President and CEO Dion Weisler has laid out a focused, clearly communicated strategy of immediate, medium and long-term goals.

Near term, our focus revolves around two main businesses – printers and PCs. Then we have initiatives to drive innovation and growth, like our HP Instant Ink subscription service and device-as-a-service offerings for our printers, and soon PCs. Finally, we see the future in 3D printing.

From a supply chain standpoint, I think that the fact that we have a “seat” at the table and a voice that is respected and appreciated has also been tremendously valuable in this transition period. There has been, and continues to be, so much collaboration and teamwork within our cross-functional leadership team, and we see that mirrored throughout the layers of the organization. Sales, supply chain, product development – we all work together and support each other. I think that has been key. Without that kind of teamwork, we would not be as successful as we are today.

“From a supply chain standpoint, I think that the fact that we have a seat at the table and a voice that is respected and appreciated has also been tremendously valuable in this transition period.”

SCN: Tell us more about your new service programs like HP Instant Ink and Device-as-a-Service. How does this shift from product focus to a more sustained service model impact the supply chain organization?

SP: Like many hardware companies, HP is investing in new technologies and processes that will enable us to expand our revenue stream into services and solutions. For example, HP Managed Print Services is a product-as-a-service solution that enables customers to pay us on a usage basis rather than having to buy a fleet of printers. This helps customers reduce costs, enhance security, and improve resource use. Similarly, our HP Instant Ink program is essentially an “ink-as-a-service” offering in which consumers pay for ink on a per page basis. The program employs the Internet of Things strategy to ensure customers never run out of ink at the wrong time. To accomplish this, the ink cartridges have sensors that register when the ink runs low, and the printer sends a signal to our supply chain for replenishment.

These are strong businesses for us, and customers like the ability to move their costs from capital to operational. But these kinds of programs also require a high degree of cooperation between the product development and services teams. We are on the hook to make sure these machines are highly available, always up and running, and always upgraded – and that requires a tremendous attention to detail because we now must manage a device not for a single sale, but for the lifetime of the unit.

Since not every product is suited to a device-as-a-service model, our HP teams must work together to figure out how to best develop products that can support this model. That includes working closely with product teams on the capabilities we’ll need, including processes for seamless upgrades and instrumentation for predictive maintenance. At the same time, when we are doing testing and diagnostics and looking at failure rates, we must work hand in hand with the product groups to determine the quality and serviceability metrics we need and then work with our R&D and engineering teams to develop the right solutions.

I think as more companies get into service-based models, they will have to look at how to most effectively stitch together the teams across their organizations to develop the capability to sell products as a service.

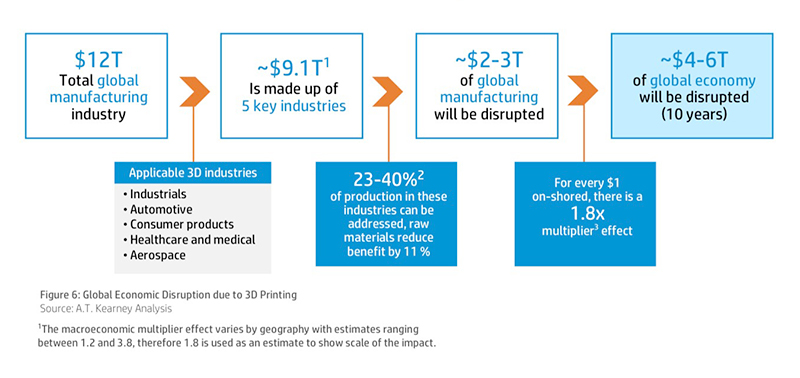

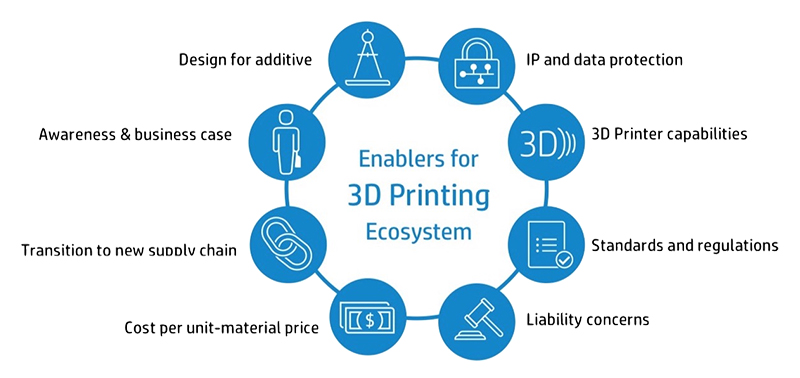

SCN: A recent study by HP and ATKearney estimates that $4-6 trillion (USD) of the global economy will be disrupted and redistributed in the next 10 years due to the accelerating growth of 3D printing. What is your take on the additive manufacturing opportunity?

SP: As a supply chain manager, when I look at a relatively new technology like 3D printing, I say, ‘show me the numbers.’ If the math, in terms of economies, doesn’t make sense, I am not going to do it. Honestly, I have been somewhat surprised by how quickly the price/performance ratio has improved with each new iteration of this technology. For example, just last year, the break-even point for large-scale 3D production of parts with Multi Jet Fusion was up to 55K units or less. That break-even point has already doubled to 110K units or less.

And, when we produced our first 3D printer, we determined that it made more economic sense to 3D print nearly half of the parts for that printer. That meant around 60 parts in the printer being produced with Multi Jet Fusion. Now, because the economics have become more compelling, and our design techniques have advanced so much, our second-generation printer now has 140 3D-printed parts, and we expect that number to keep growing. It’s essentially the printer that prints itself. There is real poetry to using your own technology to generate competitive advantage. Even more than that, we are applying those learnings and technologies to the entire HP product development lifecycle across all businesses – from conception to design to production to distribution to end-of-life. We are creating a microcosm with our own business for the way we see the entire $12 trillion global manufacturing industry being digitally transformed from top to bottom.

“There is real poetry to using your own technology to generate competitive advantage.”

I think the aspect of 3D printing that many people may not understand is that this is not just about replacing metal parts with plastic parts. Additive design is an entirely different approach. So, we can look at an old unit and find a section that had maybe six different parts, 14 screws and a couple of gaskets. We have figured out how to turn that into a singular 3D printed part, which is a massive efficiency on many levels. It enables us to realize significant cost savings by reducing the overall number of parts in a bill of materials (BOM). Then by doing what we call topological design, we further increase the efficiencies by removing all the excess material that is not essential to the operation of that part. In many cases, these parts don’t just work “as well,” but better than the original because there is no unnecessary weight or mass. Furthermore, Multi Jet Fusion allows for flexible manufacturing, where design tweaks and iterations can essentially be applied in real-time, without having to “stop the presses” and produce new physical molds every time there is a new learning or modification.

SCN: Where do you see the strongest market potential for 3D printing?

SP: Well, as you noted, our study forecasts significantly accelerating pickup of this technology, so clearly, we can expect adoption to come across a number of sectors. Heavy industry, automotive, consumer products, healthcare and aerospace are some industries that are already seeing economic benefits from 3D printing.

The prototype market is obviously another area, but today that market is still relatively small when compared to the overall global manufacturing market. 3D printing isn’t going to replace high-volume, million-unit manufacturing in the near-term. But as the economics of using Multi Jet Fusion for production continue to improve, we will see increasingly wider adoption. Supply chain managers and design managers need to think how this could change how they manufacture and design, because that shift is inevitable.

Another area where additive manufacturing has great potential is in longer lifecycle products that need extended support. The beauty of 3D printing is that you can encapsulate the entire lifecycle with that one technology – prototype, production, service, end of service – you have the part for life.

Source: A.T. Kearney Analysis

There is also a lot of opportunity for better supporting nearshore/on-demand kinds of production. It allows for much quicker response time, fewer logistics considerations, etc. There is little doubt that 3D printing technology is on its way to changing how we design, produce and consume everything.

SCN: HP received a perfect 10 from Gartner for its Corporate Social Responsibility initiatives. Tell us about how your supply chain organization supports environmental and social sustainability.

SP: Sustainability has always been important to HP, but I think that in recent years we have taken this commitment to new levels, where it truly has become central to our business. It motivates us to think differently about how we approach the entire lifecycle of our products. We look at our products and processes now through more of a circular economy lens, with an emphasis on materials and energy efficiency. We are also committed to addressing a range of socio-economic and humanitarian issues within both the global supply chain and the communities in which we operate. I’ll share a few highlights, but I would encourage your readers to go to our Sustainability portal to learn more about the full gamut of our CSR activities.

One effort that I think is particularly interesting is our use of recycled materials in our closed-loop recycling process. In and of itself, the fact that every day we use recycled plastic from one million water bottles in the production of our ink cartridges, is, I think, impressive. But, there is another aspect of this program that I think really demonstrates how powerful these kinds of efforts can be. Last June, HP started selling the first ink cartridges made from plastic bottles collected in Haiti, a country that was devastated by an earthquake in 2010 and whose citizens rely on bottled water due to a lack of access to clean drinking water. These bottles were creating a massive waste problem in the region. So far, we have removed and recycled 90,000 kilograms of material from this still-struggling island.

HP also feels a responsibility to do what we can to help improve the lives of the many workers in the extended supply chain that are vulnerable, either due to a lack of education, age, migrant status, etc. We do not want to be part of a network that either actively or tacitly allows unfair, unsafe working conditions. In 2016, HP co-founded the Leadership Group for Responsible Recruitment, an organization that is dedicated to combatting exploitation, forced labor and trafficking of vulnerable and migrant workers in global supply chains. More recently, we teamed up with our customer Diageo to develop a new leadership training program supporting women in China and Malaysia called Plan W.

“We look at our products and processes now through more of a circular economy lens, with an emphasis on materials and energy efficiency.”

SCN: Any final thoughts?

SP: I think it’s important to recognize that HP’s recent successes have depended on the ability of our leadership – and our employees as a whole – to stay focused on our business strategy while at the same time being agile enough to recognize and capitalize on new business opportunities. For example, the ability to redesign our products and transform our supply chain capabilities has already allowed us to shift to successful service-based models. I expect we will continue this transformation as we look to the future of computing, including 3D printing.