Taking the Pulse of Your Supply Chain

Emerging role of sentiment analysis in demand-driven supply chains

Recent trends in supply chain management have been driven by the attempt to understand supply chains and mitigate the remaining “risk [that] comes from not knowing what you’re doing” (W. Buffet). Sensors and smart tags launched a new era of supply chain managers tracking and tracing items throughout the entire lifecycle; this has created many new opportunities for big data analysts to understand the current status quo and identify support for decision making under uncertainty. However, the promises of these approaches to develop full visibility through end-to-end transparency has not been achieved despite the continuous integration of supply chain management techniques to improve the management over one or more echelons.

While increased visibility and collaboration is supported by the use of sophisticated Information and Communications Technology (ICT) and techniques such as Radio-Frequency IDentification (RFID) technology, Vendor Management Inventory (VMI) or Collaborative Planning, Forecasting and Replenishment (CPFR), managers still fear the “demand amplification” or bullwhip effect as small demand fluctuations in the marketplace travel upstream in the supply chain and cause an overreaction to changes of order sizes.

In theory, companies in a supply chain share a common objective and, therefore, unrestricted and immediate access to all relevant information and data should be standard; especially considering the given global connectivity of the information technology era. Traditional supply chains have limits in alignment and visibility between two parties, a restriction that is not necessarily true anymore due to access to intelligence such as Point-Of-Sale (POS) data that can be provided back to the suppliers without delay. Given these opportunities, it leaves us with the question: why is the bullwhip effect still so common?

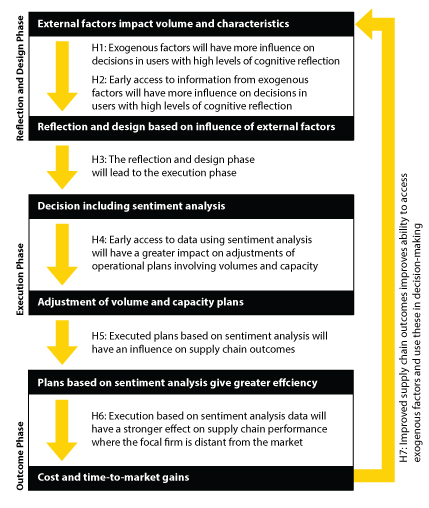

Professional literature suggests manifold proposals to address the problem by re-defining information flows endogenous to the supply chain; yet overlook the obvious alternative: empower all companies along the supply chain to embrace ready-to-access exogenous information to enrich their data warehouse with current marketplace data to react faster with higher accuracy.

Marketing researchers and practitioners have demonstrated the depth of data available within the social media domain and have established a clear correlation between what is being said by consumers and sales figures. Think about it – people continuously create market data by writing what they see in and think about a product. All of these commentaries are textual information that is readily available and easily accessible by companies. The beauty of this data is that it represents the market as it is generated by consumers, for consumers. The practice of using social media inputs to forecast sales is called sentiment analysis, consumer sentiment analysis or opinion mining. The retail sector has led the way in adoption of this strategy, but we believe that sentiment analysis could be a valuable tool for supply managers as well.

“The beauty of this data is that it represents the market as it is generated by consumers, for consumers.”

Upstream supply chain managers can readily access consumer-generated data at any time, from anywhere in the world. That is, they can get the visibility to that marketplace through the consumers and access that data which, as we know from the marketing discipline, is effective and replicates actual sales and market data. Consider a supply chain manager in Asia running analytics to see and understand the market acceptance of a new product in Europe. Evaluating market acceptance enables them to judge whether or not the products have been well received. In which case, they want to produce more and ensure that they have secured supply for the future. On the other hand, social media data might indicate that a product is a complete disaster; in which case, efforts might be made to try and reduce future orders and reallocate resources internally.

The sentiment analysis data represents actual consumer perceptions of the product (which links to sales), and it is generated at the same time or even in advance of sales. Being able to estimate sales to consumers means that an upstream supply manager can predict sales ahead of time, even if they are geographically distant from a market or there are many other echelons between them and the consumers.

In this way, a supply chain manager in Asia does not need to rely on second-hand inputs from supply chain partners to get this intelligence. Consumer sentiment data can be used as part of Sales and Operations Planning to establish forward projections of demand within factories. The data analysis should enable the manager to respond ahead of time and prepare for the changes and orders as they work their way through the supply chain. The outcome is like the “beer game” supply chain simulation demonstrated in many business courses, but with complete transparency. It significantly dampens the impact of fluctuations along the chain and enhances the availability of supply as the various parties hold more appropriate levels of stock and respond accordingly.

“Consumer sentiment data can be used as part of sales and operations planning (S&OP) to establish forward projections of demand within factories.”

There are two natural limitations to this approach. First, it is not, by itself, a silver bullet that would revolutionize supply management activities. It should only be used in conjunction with other established methods when making supply management decisions. Second, not all products produce such consumer excitement and thus consumer commentary; the approach may, therefore, be somewhat less valuable for firms that focus on industrial outputs.

Ed. Note: This commentary is based on a research report by Wood, Reiners and Srivastava, “Think exogenous to excel: Alternative supply chain data to improve transparency and decisions,” originally published in the International Journal of Logistics Research and Applications, 0(0), 1–18.

Related Resources:

- Research Report: Complexity Theory, Sentiment And Supply Chain Organizational Behavior

- SlideShare: Insights from hashtag #supplychain and Twitter Analytics: Considering Twitter and Twitter data for supply chain practice and research

- Article: The importance of customer service for end-to-end supply chains