Supply Chains: Leading and Thriving in the Post-Pandemic World

By Stan Aronow

In late October, I had the privilege of moderating a virtual Leaders in Action (LIA) event with a group of twenty COOs and CSCOs representing a range of large global companies. This interactive event, themed “Thriving in the Post-Pandemic World,” was designed to give supply chain leaders the opportunity to share their perspectives and hear from peers about “What’s next” for the supply chain and global business as the impacts of the pandemic subside.

The specific topics we explored included:

- How will nationalistic market interventions drive further adaption of supply ecosystems and raise the risk of cyber disruptions?

- How will customer and consumer behaviors, driven by pandemic necessities, shape the future of go-to-market strategies?

- How can we leverage this crisis to accelerate workforce and digital transformations?

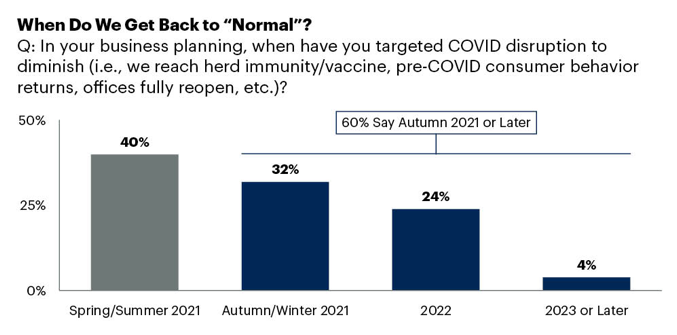

I opened the session with a question: “When do you think we will get back to our next version of ‘normal’”?

Before the recent autumn surge of COVID-19 cases, 40 percent of global CSCOs responding to our “Consult the Community (CTC)” survey projected pandemic business impacts would diminish in the first half of 2021[see figure 1]. During this late-October discussion, however, many of these leaders were humbled by the continued uncertainty of the situation and pushed their estimates to 2022 or later.

With this less-than-optimistic backdrop, we went on to discuss four high-level issues: global trade; cybersecurity; supporting the customer of the future and new ways of working.

Here are some key takeaways:

Global trade

- Most large multinationals are playing the long game when it comes to the rise of economic nationalism, particularly in context of U.S.-China relations. While a near-term change in U.S. government might lessen daily uncertainty, the direction of the relationship is based on geopolitical dynamics running on longer timescales.

- More broadly, leaders see regional trade deals picking up and creating opportunities where multilateral deals have struggled. Supply chain’s global perspective across governments, operations, suppliers and customers make it uniquely qualified to advise the executive committee’s location strategy.

“Supply chain’s global perspective across governments, operations, suppliers and customers make it uniquely qualified to advise the executive committee’s location strategy.”

- Western supply chains are maintaining communication and collaboration networks with Chinese partners, except where mandated government restrictions exist. An apparel retailer manages related reputational risk as part of its broader ethical/sustainable sourcing strategy.

- China remains an attractive market for many Western companies and is large enough to be supported as part of a broader regionalized supply network strategy, tailored to local needs. As a hotbed of supplier innovation and advanced, digital-savvy consumer practices, it is in leading companies’ interests to stay engaged.

- Several national governments are dictating local product provenance, particularly for the high tech, life sciences, and aerospace and defense industries.

- Where public entities — governments, politicians, multinational organizations — have at times shown to be lacking in the crises of 2020, private enterprise has been forced to step in. While companies would like government’s help to de-risk the investments and choices they need to make, they can’t wait for that to happen. While they would like to see tariffs and trade barriers reduced, that will also take time. Supply chain leaders are doers. When something needs to be done, they act, even if it requires reaching across borders or reaching out to competitors.

Cybersecurity

- Cyber risk is top of mind for global supply chain leaders and many see it as the next imperative on par with health and safety. Some companies recognize higher cyber risk in their legacy on-premise supply chain applications and have used that exposure to accelerate a transition to more secure cloud-based networks.

“Companies recognize higher cyber risk in their legacy on-premise supply chain applications and have used that exposure to accelerate a transition to more secure cloud-based networks.”

- One company had its enterprise resource planning system knocked offline for five days, leading it to completely retool its approach to ensuring visibility and continuity in the event of a future outage. Another company’s IT team ran a simulation of its ERP being down for eight weeks, which reinforced the need for a digital twin backup that allows it to recover and operate from such a significant outage.

Supporting the customer of the future

- Most supply chain leaders with online/direct-to-customer (D2C) models anticipate a permanent step-up in volume coming out of the pandemic period. At the same time, both D2C and business-to-business (B2B) models are being stressed by more expensive and significantly overloaded parcel shipment networks.

“Both D2C and business-to-business (B2B) models are being stressed by more expensive and significantly overloaded parcel shipment networks.”

- Some consumer/retail supply chains are exploring creative fulfillment models such as nano-hubs and shared omnichannel spaces in shopping malls paired with gig workers for last-mile delivery. Sustainable (i.e., slower, less expensive) delivery options are becoming more popular and some retailers are using behavioral techniques to nudge consumers in that direction.

New ways of working

- Many supply chain leaders are leveraging the pandemic’s near-term impacts as a pivot for longer-term transformation. One company with pre-pandemic plans for a new headquarters office has now halved the size of that space. Most leaders are seeing a hybrid office-remote approach as improving long-term employee engagement and satisfaction.

“Leaders are seeing a hybrid office-remote approach as improving long-term employee engagement and satisfaction.”

- Without a watercooler around to share, some leaders find it harder to keep a finger on the pulse of their organization’s culture. One leader sees a silver lining in remote work in terms of her accessibility to the organization and driving more intentionality in how she personally connects with others on her supply chain team.

The two hours we devoted to these topics flew by and it was inspiring to see supply chain topics front-and-center and leading the way as our companies define what’s next for all of us, post-pandemic. We look forward to the next gathering of this esteemed group in Spring 2021. If you have any thoughts on these topics or others of interest to your supply chain organization, please reach out to me via LinkedIn.

The original version of this blog post was published by the author on Gartner.com and is reprinted here with permission.

Related Resources:

- Beyond Supply Chain Blog: Next Generation Agility – An Antidote to Uncertainty

- Power of the Profession Blog: Delivering on the Extremes of Customer Preferences Via Agility

- Beyond Supply Chain Blog: Redefining Resilience – Unlocking the Potential of our Supply Chains