Dr. David Simchi-Levi, Supply Chain/Operations Researcher, Consultant, Author and MIT Professor

SCN: In the Accenture MIT Alliance in Business Analytics research paper “Linking Analytics to High Performance,” you say high performing companies “do analytics differently.” Please explain how their approach is “different.”

DSL: Our study found clear and definable differences between companies that are truly data driven and those that either have not been successful in using data or have not made a serious attempt to use data in their business. Let’s start with what high-performance companies are doing successfully:

First, they use data from external sources, such as market positioning and brand reputation, to complement internal data. This allows them to develop more effective demand-focused strategies.

Second, data is not collected and managed in silos. If the company’s marketing, procurement and operations teams all have their own data centers, the company is not going to be able to capture the full value of that data, because of inconsistency in the data, different naming conventions and different data sampling will make it nearly impossible to effectively integrate that data.

The third major difference we discovered was the degree to which data analytics is embedded into the management process. When data-driven analytics is ingrained in the company culture, it is included in the decision-making process, so that all decisions – operations, pricing, risk mitigation, etc. – are backed by a data-driven component. However, these companies also understand that being “data driven” does not mean that data is the only decision criteria; it is simply the vehicle to most quickly and cost-effectively differentiate your business and achieve your customer value proposition (CVP).

Beyond these factors, our research also identified the key barriers for companies to become data driven. At the top of the list are data quality and information confidentiality. At the same time, many companies cite internal resistance as a leading reason for either not using analytics or not implementing analytics-driven decisions. Finally, many companies lack sufficient analytical skills that will allow them to effectively apply analytics across the organization.

When data-driven analytics is ingrained in the company culture, all decisions – operations, pricing, risk mitigation, etc. – are backed by a data-driven component

SCN: Can you give an example of how data analytics can support an organization’s CVP?

DSL: One of the best illustrations of the power of analytics comes from the supply chain transformation we helped to drive for Dell computers. In the 2007-2008 time frame, Dell decided to expand its direct-only sales model to offer its products through retailers such as Wal-Mart and Best Buy. Dell expected that they could use the same supply chain they had optimized for their direct sales business to support their new retail channel. But, it soon became clear that this approach was not working. The reason was that the customer value proposition for the direct and retail spaces are very different.

At its most basic level, the direct business, where the value proposition is customer experience and choice, is driven by a demand for flexibility and responsiveness, while in retail, it is all about price. To be able to compete on price, you need a completely different supply chain design and strategy than the one where you compete on customer experience and choice. Indeed, the retail channel requires an efficient supply chain where the focus is on cost reduction rather than flexibility. The analytics helped Dell to see these differences, segment their supply chains, and simplify product offering to satisfy each set of customers. Dell reported that the effort enabled them to achieve three times higher forecast accuracy and to lower both freight and manufacturing costs by 30 percent.

SCN: The Institute for Operations Research and the Management Sciences (INFORMS) has recognized your work with machine learning. Can you tell us about that?

DSL: Yes, the field of machine learning is very exciting and we’ve had great success helping customers in the fashion sector employ this technology to better predict demand and optimize their pricing. We have one client, Rue La La, which is in the online sample sales industry, where they offer extremely limited-time discounts (“flash sales”) on designer apparel and accessories. Rue La La’s main challenge is pricing and predicting demand for items that it has never sold before (“first exposure” items), which account for the majority of sales.

Traditionally, the company applied cost-plus pricing strategy, but this was not working well; some products sold out very quickly while others did not sell at all. We developed a machine-learning algorithm that uses information from similar products in the market, such as the category of product, the color popularity, size popularity, brand type, etc., to create a price/demand relationship. That data goes into an optimization model that is integrated with Rue La La’s ERP system, and every night the algorithm generates prices – product-by-product, department-by-department. Using this algorithm, Rue La La has reported a 10 percent improvement in revenue.

Another example is work done with a large mining company using machine-learning techniques on the data collected from thousands of sensors embedded in the production equipment. We were able to predict quality issues 5 to 10 hours before they happened.

Analytics enabled Dell to achieve three times higher forecast accuracy and to lower both freight and manufacturing costs by 30 percent.

SCN: Tell us about the analytics framework you developed to help companies identify hidden risk in the supply chain.

DSL: Firms are exposed to a variety of low probability/high impact risks, which may disrupt their operations and supply chains. These risks are difficult to predict and quantify, and therefore, difficult to manage. As a result, managers may deploy countermeasures suboptimally, leaving their firms exposed to some risks, while wasting resources to mitigate other risks that would not cause significant damage.

We developed a risk exposure model that assesses the impact of a disruption originating anywhere in the firm’s supply chain. Our risk exposure index takes into account Time-to-Recover (TTR), which represents the time it takes for a specific facility to recover to full functionality after a disruption. It also takes into account the entire network and considers a range of factors, including the complexity of the business, profit margins, production volumes, bills of materials and pipeline inventory.

To determine risk, we simulate a disruption anywhere in the supply chain and determine the best response the company can make for the duration of the TTR. So, for example, if a specific facility’s TTR is three weeks, we simulate the operation of the supply chain without this facility for the duration of the three weeks and we figure out how to allocate resources effectively without that facility in play. Such an analysis informs decision makers about where to focus their limited risk management resources. We applied this new technology to Ford’s supply chain and enabled the company to identify previously unrecognized risk exposures and develop mitigation strategies, track changes in risk exposure, and respond more effectively to disruptions.

SCN: The success of this model hinges on the accuracy of your data. How can you be sure suppliers are not skewing the numbers to paint themselves more favorably?

DSL: That is certainly a possibility we anticipated. So, we developed a related concept called Time-to-Survive (TTS), which does not require any supplier input. TTS tells us the maximum duration that the supply chain can match supply and demand without the specific facility. If the TTS for a specific supplier is one or two days, then you know this is a bottleneck supplier so that you need to work closely with them to improve their TTR.

At the same time, you may find there are suppliers with a very long TTS, which likely means they are sitting on a lot of inventory. This knowledge can provide an opportunity to cut some cost from that pipeline.

We once worked with a large telecom company that had a policy to keep about 30 weeks of inventory for every component in their Bill-of-Materials. We helped them identify areas where this was unnecessary, and they were able to cut their inventory carrying costs by millions of dollars.

The only way to know if you have the right data, the right people and the right skills is to just start simple, build your confidence, and leave the complexity for later.

SCN: Are you ever surprised by the results from a supply chain data analysis?

DSL: Through the years, we have learned that data can lead you to quite unexpected places. For example, we have worked with many clients helping them to define a risk mitigation strategy, and most often, they assume that their greatest risk exposure is associated with those suppliers with whom they have the highest total spend.

But, when we apply our Risk Exposure Index (REI) model, we usually find that is not the case. A more important factor is the criticality of the part or service they provide, but this is hard to detect without analytics because of the sheer number of suppliers and parts. Indeed, we have seen the scenario played out time and again where a missing ten-cent part can shut down a billion dollar production facility.

Similarly, the analytics we developed and applied for revenue management, including machine learning and price optimization, have made a much bigger than expected impact on online retailers such as Rue La La.

SCN: Supply chain professionals are still under pressure to justify investments in risk mitigation strategies. How do you quantify the value of something that doesn’t happen?

DSL: Using the TTR and TTS frameworks, enterprises can actually calculate the true ROI for the resources they commit to risk mitigation. For example, they may need to invest in inventory or an additional supplier and can show that this can save the company from very high quantifiable risk at a relatively low cost.

SCN: How would you characterize the current rate of adoption of data analytics among multinationals?

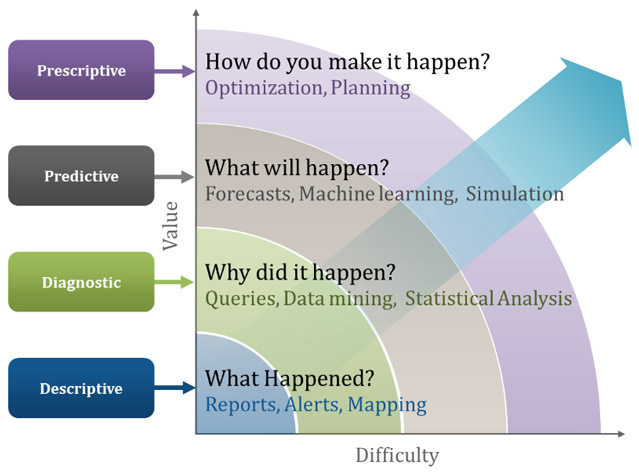

DSL: Well, I think that there is still a great deal more talk than action going on. There are certain sectors, like the fashion industry, that have moved well beyond the first two levels of analytics maturity – descriptive (use analytics to answer the question “what happened?”) and diagnostic (“why did it happen?”) – and are successfully implementing predictive (“what will happen?”) and prescriptive (“how to make it happen?”) analytics to grow market share and optimize revenue. We have also seen a handful of pioneers across a range of other sectors, including high-tech, pharmaceuticals and automotive, that are doing some impressive work. But, overall, we see a continued resistance to change, as well as a scarcity of available data analytics specialists, as two of the most common obstacles.

SCN: So, it’s the typical “old dog, new tricks” problem?

DSL: No, I think it goes beyond simply being stubborn. Many of today’s executives have risen through the ranks without the benefit of sophisticated data analytics, so a large part of their decision-making process is simply based on “gut” instinct. So, when the analytics output differs from their instinct, it is understandably difficult for them to accept the notion that “raw” numbers and a “black box” can accurately reflect the intricacies of their business better than their intuition.

SCN: Any final thoughts?

DSL: Data analytics is still such a new area and there is no one standard approach, so it is hard for companies to know where to start. But, not doing anything is not a choice. For example, if you think about pricing in retail or high tech, the first thing you want to do is look at your data and determine how to develop an effective predictive model. If you can do that, you are ready to move to the price optimization level. Most companies get stuck trying to figure out how to do everything in one big bang approach that may be trying to accomplish too much. The only way to know if you have the right data, the right people and the right skills is to just start simple, build your confidence, and leave the complexity for later.