Q&A with ECIA Chief Analyst Dale Ford

SCN: Can you give us an update on what ECIA is seeing in terms of the impacts of the global pandemic on the electronic components sector.

DF: Of course. As it became clear in January that the Covid-19 virus was not merely a local outbreak in the Wuhan province, ECIA began conducting bi-weekly surveys of member manufacturing and distributor companies so we could provide our partners, and the tech sector at large, with as much visibility as possible into how the evolving crisis would impact the supply chain.

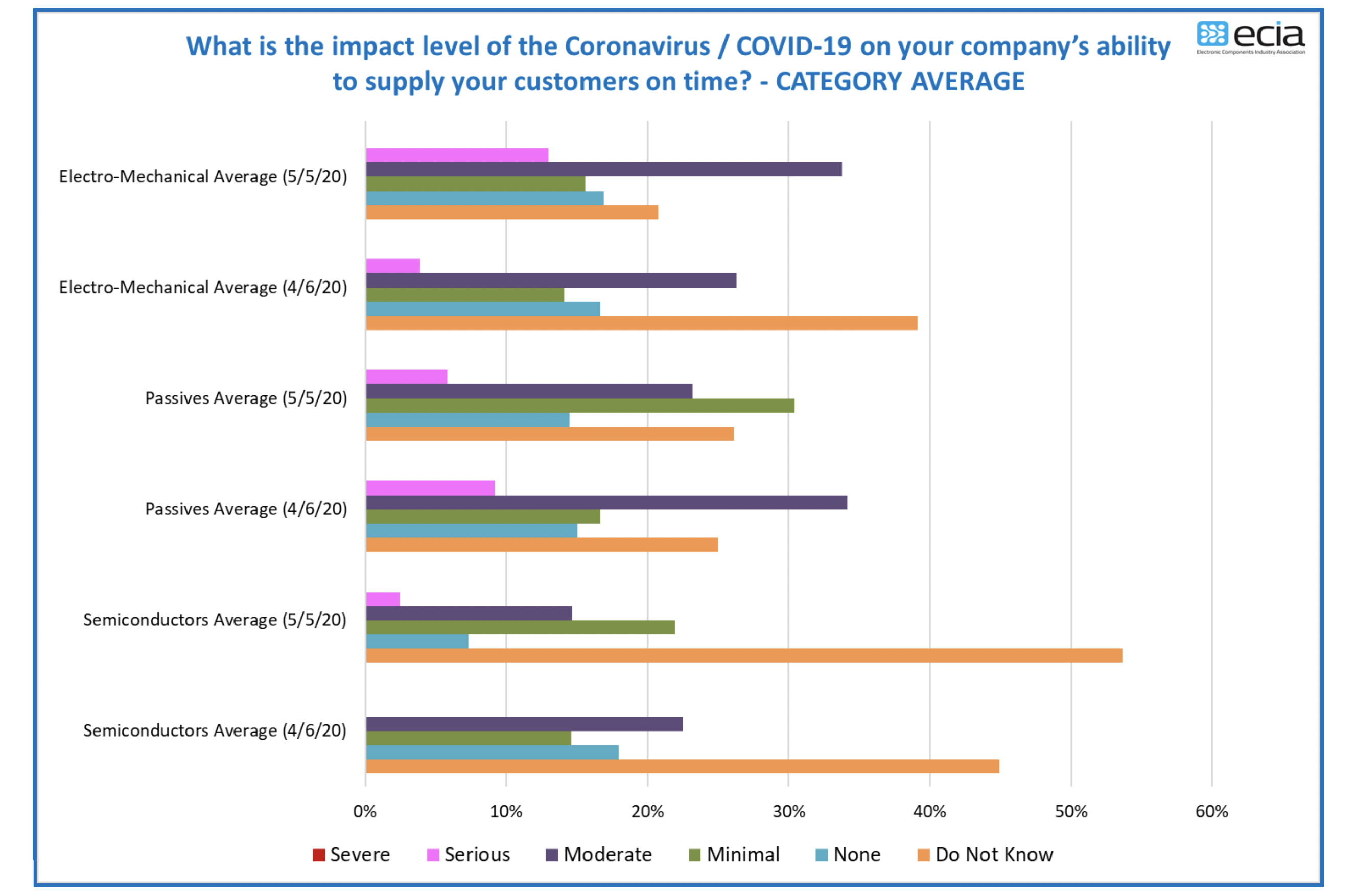

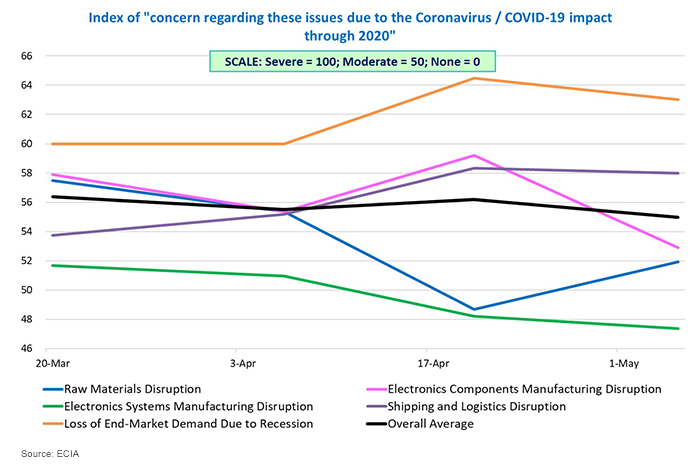

In the most recent survey, for the two-week period between April 28 and May 5, we saw some mixed signals about concerns for end market demand and the overall health of the supply chain. For example, there was a significant improvement in the perception of the impact of government restrictions and quarantine orders on businesses. Only 16% report a serious or severe disruption, while 46% now see minimal to no impact on their operations or workforce. At the same time, we saw a slight increase in concern regarding end market demand, with automotive and industrial electronics markets representing the segments of greatest concern. Expectations of a decline were reported by 72% of automotive electronics respondents and 55% of industrial electronics companies.

Despite expectations for weak end-market demand, the confidence in order backlog remains quite robust in every product segment. Weak expectations were reported by less than 16% of respondents in all major categories. The semiconductor segment continues to show the highest degree of confidence.

When you contrast these results with data from before the outbreak, it really illustrates how dramatically this has upended the tech sector. For example, World Semiconductor Trade Statistics (WSTS) report for sales through the end of February indicated that we were just on the verge of a solid growth year. For the first time in over a year the Q/Q data point had jumped positive up to 5 percent annualized growth rate. The curve was bending upward, it was still in negative territory, but it was trending upward. So we felt as though we were setting up for the beginning of another growth cycle after what was admittedly a very tough 2019.

SCN: Given the completely unprecedented scale of this disruption, is it realistic to think companies could possibly be “prepared” for this?

DF: I remember a conference about 10 years ago where the CEO of General Electric explained that they were seeing such an increase in the number of disasters that the management of the company had moved to a footing of a continual “crisis-mode management.”

At the same time, there is no question that we are experiencing a once-in-100-year type event. And when you consider that the modern electronics industry isn’t even 100 years old, we are in completely uncharted territory. A crisis by its nature is typically unexpected in nature and magnitude, but there is a significant difference this time in how this has evolved from being a regionally focused crisis to a global epidemic, impacting both supply and demand.

I would say that is not really possible for any company to “prepare” for the specifics of this crisis, but the reality is that for at least a decade now, the tech sector has been dealing with an ongoing crisis in one form of another –whether it is a natural disaster, trade wars, etc. So, I think that effectively managed companies should have already been oriented toward an ability to implement systems and processes for crisis management.

SCN: What are some best practices that you have seen or would recommend for managing business in a crisis like this?

DF: This is an event that will push the skills of even the best leaders to the limit as they must balance action with caution. The broad-based assault of this crisis on a company dictates that this be an “all-hands-on-deck” approach, which is why I think organizations need to begin by establishing a “war room.” We typically hear about this concept in the political arena where campaigns have to be able to respond quickly and effectively to unexpected events while at the same time organizing a longer-term strategic approach that can be adapted to evolving events.

In this case, key participants are needed from across the organization, including operations, finance, marketing/sales, procurement, communications, HR, etc. It is critical that each leader implement a clear line for communications for distilling concise reports and directing implementation of decisions. This is a time where activities such as communications with customers and suppliers and monitoring the surrounding environment becomes critical. Leaders must be careful not to fall into analysis paralysis, but at the same time their actions must be assertive enough to protect the company and its stakeholders.

I also think this experience has illustrated the benefits of being flexible and nimble. For example, it is amazing to see how automotive companies have shifted to the production of ventilators and producers of a wide variety of materials have shifted to the production of PPE gear such as protective masks and gowns. There are many examples of stand-out companies whose ability to quickly adapt enabled them to meet urgent needs in this crisis. So, I hope we will see more companies exploring ways to more deliberately implement production processes that enable rapid, effective shifts.

SCN: How might this pandemic impact the role China plays in the tech supply chain going forward?

DF: I think it will be difficult to put the genie back in the bottle after this crisis. The U.S.-China trade war last year had already lead to a significant drop in component imports in almost every electronic component category to the U.S. from China, according to import/export data by U.S. Commerce Department.

I expect that concerns over how this virus was managed and how information was communicated will increase the urgency of the shifts that were already in play. There is an increased recognition that in the competitive environment that is being set up between the two largest economies in the world, you cannot leave yourself at the mercy of your number one competitor.

“Tech companies need to reassess the risk analysis they perform as they make decisions regarding supply chain partners and structures.”

I understand that businesses want access to the market in China, but they need to remember that China has an aggressive plan to develop their own domestic businesses to compete on a global stage. Any companies currently doing business in the region, or looking to, must take this into account in their planning. They need to consider how to appropriately position their business knowing that they are going to have a very significant competitor emerging from China. If you are heavily reliant on China and believe you are going to have a level playing field, you are in a very risky business position.

SCN: Which segments in particular do you expect will be impacted?

DF: We are seeing legislation produced in the U.S. to regain control of critical industries such as medical equipment and supplies and pharmaceuticals. I expect we will see this move into other areas that are deemed essential for the economic and physical security of the nation, including certain industrial applications, automotive and telecom equipment.

That doesn’t mean that all this production will necessarily move to the U.S., but it may, wherever possible, shift to other parts of Asia, including Vietnam, which is more assertively promoting manufacturing in the region. India has also become more insistent on local production for companies that want to serve the Indian market.

The biggest challenge in making any of these changes will be developing the infrastructure that has to be in place to support production as well as capabilities with raw materials supply. Even if you shift the supply chains, it will take time to develop supplies in rare earth minerals that are critical for semis, batteries, etc. It’s not something that can be built overnight.

One thing that is clear is that this pandemic has revealed vulnerabilities that will need to be accounted for as companies shift their supply chain strategies for the future. Tech companies need to reassess the risk analysis they perform as they make decisions regarding supply chain partners and structures. The ROI calculations that companies make when they determine where to source products and which countries and companies to partner with will need to be reviewed.

SCN: What are your thoughts on the likelihood of a global recession?

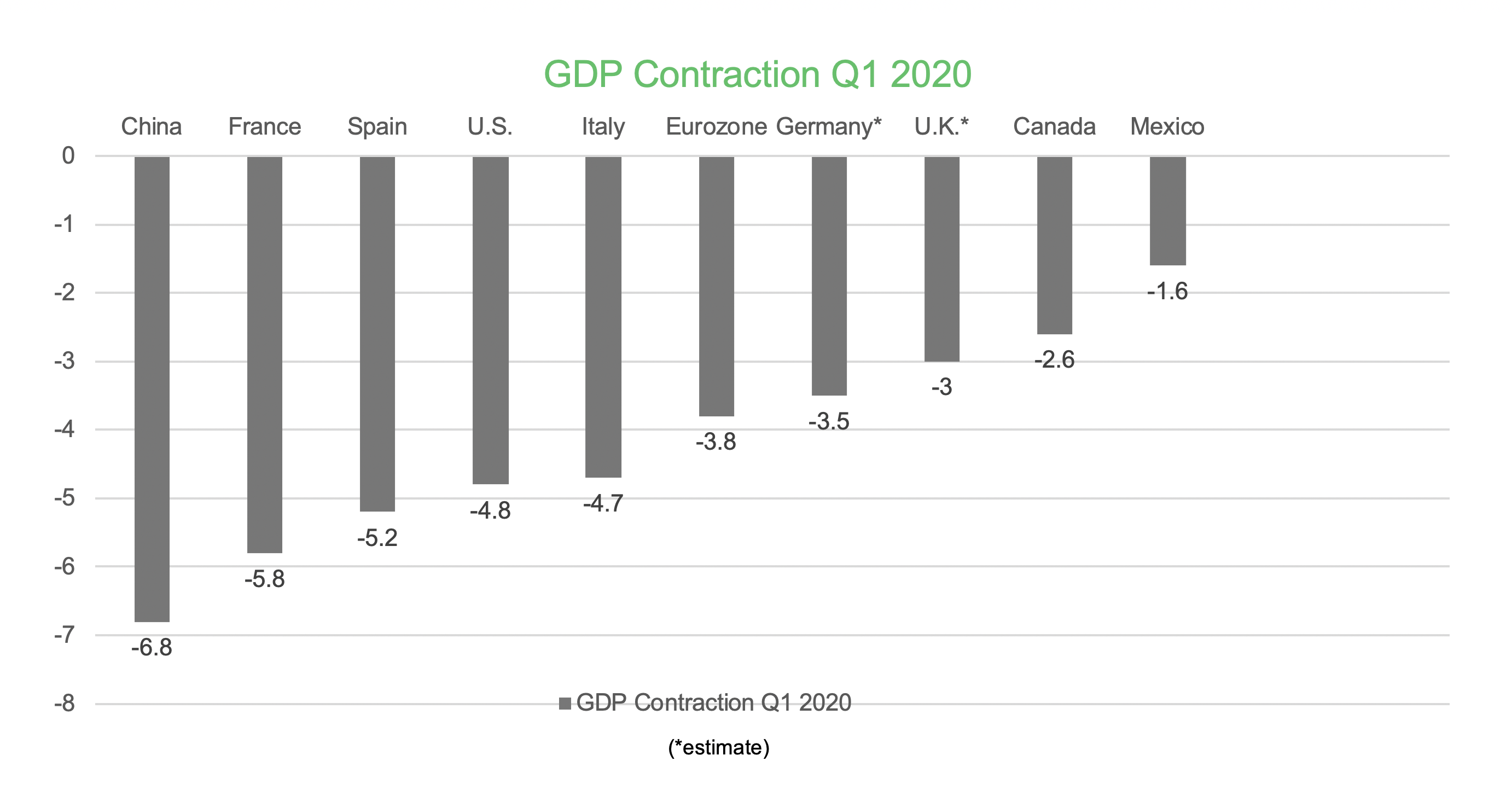

DF: The rapid spread of the COVID-19 virus has set the global economy up for the worst growth downturn since the 2008-09 financial crisis. There is little disagreement that the global economy is going to fall into a recessionary period. That it pretty clear. The IHS Markit forecast for world real GDP growth in 2020 has been revised down to 0.7% in response to the spread of the virus. All told, U.S. real GDP should fall 0.2% on a calendar year basis in 2020. Growth is not expected to return until the end of the year.

As bad as we are feeling this in the U.S., other regions are suffering even more. Data released over the past two weeks shows the devastating economic impact on major economies so far this year, and unfortunately, many market watchers expect Q2 to be even worse.

Economic Contractions in GDP Q1 2020 (compared to Q4 2019)

Sources: China, France, Spain, U.S., Italy, Eurozone, Germany, U.K., Canada, Mexico

SCN: As the prospects of a V-shaped recovery dim, what factors concern you most about the economic outlook through the end of 2020?

DF: The greatest issue, without question is going to be how small businesses withstand the shutdown. The legislation that was passed in the U.S. has not been as effective as anticipated, primarily because the execution of these initiatives has proven much more complicated than expected. The staggering number of applications that were filed for support through the Small Business Administration has completely overwhelmed them.

A survey released late last month by the NFIB Research Center, which is the largest small business advocacy organization in the U.S., found that only 20% of applications submitted for Small Business Administration –based loans had been fully processed with funds deposited in the borrower’s account, while 80% of applicants still did not know if they were approved, or when they might see some funds.

Not surprisingly, this is leaving these businesses pretty pessimistic about the future. NFIB reports that only one-third of small business owners believe their community will get back to a “normal level” of economic activity by the end of the year, while 25% don’t expect a return to normal until 2022.

Another challenge to a more rapid recovery is the piecemeal approach we are seeing as the process is being driven largely state-by-state and country-by-country. Within the U.S., the choices of different governors in their planned economic recovery varies widely and as a result, I see evidence of the development of an “underground economy” developing, as people in small businesses determine they can no longer wait for the government to officially act to ease restrictions.

SCN: With a combination of historically low interest rates and small businesses weakened by the economic slowdown/shut down, should we expect to see a spike in acquisitions/consolidation in the coming year?

DF: This is definitely something I anticipate we will see more of in the wake of the recovery. It was interesting to me that as the government looked at spending one of the proposals was a major infrastructure spend, because with the low interest rates there may never be a better time to invest in these types of initiatives. I think you could look at that from a business perspective as well. If you are interested in financing some activities in the M&A space – the interest rates available right now make that a very attractive proposition.

“If you are interested in financing some activities in the M&A space – the interest rates available right now make that a very attractive proposition.”

Obviously companies are positioned differently in how they are financially positioned to weather this crisis, so I think that some companies are likely to look at what opportunities exist. We have seen this occur in past cycles and I expect we will see it again in this cycle.

Forward thinking companies may also look at this as an opportunity to strengthen relationships across their supply chains. I remember years ago when Intel invested in some of its small suppliers to provide them the means to develop new technologies and processes that were valuable in enabling/stimulating the sale of core Intel products. It was a very intelligent strategy that definitely paid off for Intel. Unfortunately, right now, I think many major companies are so focused on near term survival that their financial actions may be placing even greater stress on their supply chain partners.

SCN: From a technology standpoint, what impacts/developments do you think might arise from the pandemic experience?

DF: One of the most clear outcomes I see coming from this is a greater awareness of our “touch points” and the desire to reduce them. So, one opportunity that jumps out to me is an increase in the use of sensors and automation technologies to eliminate certain contact points, such as opening doors with handles, etc.

Obviously, the sudden influx of remote work and learning has also put a strain on our data centers and communications networks. We have already seen evidence that demand for memory is surging, based on Samsung’s Q1 performance. I think this also makes the need for more robust communications networks through 5G rollout even more evident.

We will also likely see increased implementation of AI and use of big data for things like contact tracing, in order to stem the spread of this and other contagions in the future. Here we have the opportunity for technology to help, but also it raises complex issues around tracking populations and privacy concerns. So, that is something I expect we will be hearing a lot more about in the coming months.

SCN: Any final thoughts?

DF: There is a growing sense of urgency to reopen the economy. Just as the government is now planning and preparing for the next phase in this pandemic battle, companies must consider what re-opening the economy will look like on a regional, national and global basis, and then based on that outlook, determine the best course for their particular business.

The future now looks very different from what it did three months ago. We cannot expect to step back into business as usual. Business leaders need to consider how this experience has changed strategy and direction. Think about what are some specific characteristics of this new future that will be distinctly different from the world as we experienced it prior to this crisis.

“The future now looks very different from what it did three months ago. We cannot expect to step back into business as usual.”

The good news, I think, for the tech sector is that one of its greatest attributes has been its ability to learn and improve with every disruption. If we look back over the past decade or so, we had the Japanese earthquake/tsunami, the 2008 recession, etc. Our industry has made adjustments and changes to improve performance and protect itself from disruptions.

There is no doubt in my mind that the supply chain is much more resilient and responsive than it was 10-20 years ago. So, I expect our industry will once again learn from this experience and we will see adjustments and changes made to our operating models, and accelerated adoption of enabling technologies like blockchain and artificial intelligence, that will help our industry move forward.

Related Resources:

Report: Manufacturer Response to COVID-19 Disruptions: Increased Interest in Automation, Reshoring

WEF Blog: Managing COVID-19: How the pandemic disrupts global value chains

ECIA Survey: COVID-19 Impact and SBA Assistance

IMF Report: World Economic Outlook: The Great Lockdown